PROFESSIONAL TAX SOFTWARE REVIEWS 2015 PROFESSIONAL

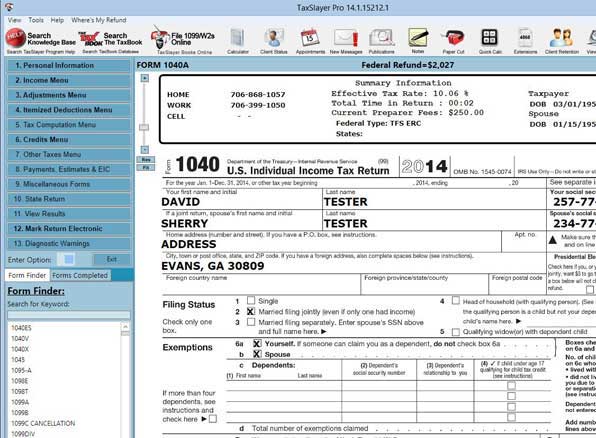

Ultimately, there is no universally correct answer to the question of hiring a tax professional or doing your taxes yourself with software. For busy non-tax professionals, their time can generally be better spent earning money in their area of expertise. Even if your tax situation is straightforward, hiring a professional will save you the time and stress of doing your taxes. Taxpayers who find themselves at the center of complicated business and investment matters may even have the skill to sort through their taxes on their own, but is it worth their time? A professional tax preparer is so familiar with the system he or she can quickly and easily accomplish tasks that might take even skilled taxpayers hours of research. For example, a tax accountant can provide you advice on tax-friendly ways to save for your children’s education, or how to reduce taxes on your capital gains.Īccountants Can Answer Your Questions Year RoundĪs a trusted professional, a good accountant will be able to answer important questions that arise not just during your annual consultation, but at other times during the year.Ī CPA Saves You Time When Handling Complicated Issues According to Wehner, who has been preparing taxes for 45 years, “A tax professional is often able to make valuable tax savings suggestions that a software program just can’t anticipate.” The value of this advice can easily exceed the additional cost of consulting with a professional. Like a good family doctor that knows your medical history, you can develop a relationship with an accountant so that he or she understands your family’s financial situation and future goals. By automating much of the data entry and organization, there’s less chance for human error to hurt your tax return. These more advanced programs have the ability to quickly scan your information and organize line items and forms correctly. The Benefits of Hiring a Professional Accountant Better SoftwareĪccountants pay around $1,000 to $6,000 for their software, which is far more sophisticated than the products sold to consumers.

The upfront savings of using tax software over an accountant is one of the most attractive benefits of filing your own taxes. On the other hand, the least expensive tax preparers will cost at least $100 and a CPA is likely to charge at least twice that amount. The price of tax preparation software ranges from the $10 to $120 range to websites that offer the service for free. There is no way around the fact that you will pay less for a software package than you will to hire a CPA or another qualified tax professional.

The Advantages of Using Tax Software Price While the ever-improving selection of tax preparation software certainly makes it easier to do your own taxes, it has hardly put Certified Public Accountants (CPAs) and other personal tax preparers out of business. “”With every important job comes the question of whether or not individuals should do it themselves or hire a professional. An Accountant: Which Is Right For You? By Jason Steele | Updated January 29, 2014 Here is that article for your consideration as you choose the best steps to take regarding the preparation of your federal and state income tax returns. We came across an interesting and concise article online on Investopedia that explains your options clearly. There are also good reasons to choose a professional accountant. Many times, incorrectly entered numbers cause automatic equations to produce the wrong totals.ĭon’t misunderstand, there are good reasons to choose tax software to help you complete your income tax return on your own. Often, it has to do with not knowing the right questions to ask to discover their best options. This as today’s tax liabilities and concerns are growing more complicated than they’ve ever been.Ī recent Wall Street Journal article revealed as taxpayers try out new tax software tools, they are making more and more mistakes. Today there are dozens of preparation software options online and in software packages that can help a taxpayer complete their tax return.

As we enter into the peak of tax preparation season, we are often asked about the difference between using tax preparation software and using the services of a professional accountant.

0 kommentar(er)

0 kommentar(er)